dallas texas sales tax rate 2020

Texas has state sales tax of 625 and allows local governments to collect a local option sales tax of up to 2. Lowest sales tax 625 Highest sales tax 825 Texas Sales Tax.

Texas Sales Tax Rates By City County 2022

Sales Tax Permit Application.

. 3400 Pearl St is a property in Dallas. Texas Comptroller of Public Accounts. Did South Dakota v.

An alternative sales tax rate of 7 applies in the tax region Dallas which appertains to zip codes 30132 and 30157. Download and further analyze current and historic data using the Texas Open Data Center. B Three states levy mandatory statewide local add-on sales taxes at the state level.

The Georgia sales tax rate is currently. 104 rows Downtown Administration Records Building 500 Elm Street Suite 3300 Dallas TX 75202 Telephone. The Texas state sales tax rate is currently.

The Dallas Georgia sales tax rate of 7 applies to the following two zip codes. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 825. Sales Tax Calculator Sales Tax Table.

The rates shown are for each jurisdiction and do not represent the total rate in the area. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. This table shows the total sales tax rates for all cities and towns in Dallas County including all local taxes.

2022 Tax Rates Estimated 2021 Tax Rates. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax. There is no applicable county tax.

Dallas GA Sales Tax Rate. County and city taxes. Wayfair Inc affect Georgia.

The minimum combined 2022 sales tax rate for Dallas Texas is. 10555 Pagewood Dr Dallas TX 75230 is listed for sale for 749900. Texas has 2176 special sales tax jurisdictions with local.

Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum sales tax rate in Dallas County is 625 not including any city or special district taxes. DALLAS CNTY COMMUNITY COLLEGE. The County sales tax rate is.

Local Sales Tax Rate Information Report. Taxes Home Texas Taxes. The December 2020 total local sales tax rate was also 7000.

The minimum combined 2022 sales tax rate for Dallas Texas is. 214 653-7888 Se Habla Español. The Dallas sales tax rate is.

Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent. The state sales tax rate in Texas is 6250. It is a 019 Acres Lot 2544 SQFT 3 Beds 2 Full Baths 1 Half Baths in Cr.

State Local Sales Tax Rates As of January 1 2020. The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas. This rate includes any state county city and local sales taxes.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. The Dallas sales tax rate is. This rate includes any state county city and local sales taxes.

Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax. What is the sales tax rate in Dallas Georgia. There are approximately 60010 people living in the Dallas area.

The December 2020 total local sales tax rate was also 6250. Average Sales Tax With Local. The County sales tax rate is.

The state sales tax rate in Texas is 625 but you can customize this table as needed to. The sales tax rate for these counties is 0 however the Dallas and Dallas MTA sales tax rates are 1 and 1 respectively meaning that the minimum sales tax you will have to pay in these four counties and the city of Dallas when combined with the base rate of. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax.

Wayfair Inc affect Texas. The Dallam County sales tax rate is. Dallas TX Sales Tax Rate.

These rates are weighted by population to compute an average local tax rate. There are a total of 981 local tax jurisdictions across the state collecting an average local tax of 1681. The latest sales tax rates for cities in Texas TX state.

The current total local sales tax rate in Dallas GA is 7000. The latest sales tax rate for Dallas County TX. 2020-2021 MO and IS Tax.

Did South Dakota v. 2020 rates included for use while preparing your income tax deduction. If you have questions about Local Sales and Use Tax rates or boundary information email TaxallocRevAcctcpatexasgov or call 800-531-5441 ext.

2020 rates included for use while preparing your income tax deduction. Records Building 500 Elm Street Suite 3300 Dallas TX 75202. City sales and use tax codes and rates.

Terminate or Reinstate a Business. TX Sales Tax Rate. Dallas Co 2057217.

Denton TX Sales Tax Rate. This is the total of state county and city sales tax rates. A City county and municipal rates vary.

The latest sales tax rate for Dallas GA. The minimum combined 2022 sales tax rate for Dallas Georgia is. 214 653-7811 Fax.

If you do business in any of these unique city areas you must use the combined area local code instead of the regular city and countyspecial purpose district codes to report local sales and use tax. While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected. This is the total of state county and city sales tax rates.

You can print a 825 sales tax table here. The Dallas Texas sales tax is 625 the same as the Texas state sales tax. Texas TX Sales Tax Rates by City.

The 2018 United States Supreme Court decision in South Dakota v. The Texas sales tax rate is currently. El Paso TX.

For tax rates in other cities see Texas sales taxes by city and county. The minimum combined 2022 sales tax rate for Dallam County Texas is. What is the sales tax rate in Dallas Texas.

The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805. 2020 rates included for use while preparing your income tax deduction. Maintenance Operations MO and Interest Sinking Fund IS Tax Rates.

What is the sales tax rate in Dallam County. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. California 1 Utah 125 and Virginia 1.

This is the total of state and county sales tax rates.

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Texas Income Tax Calculator Smartasset

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease

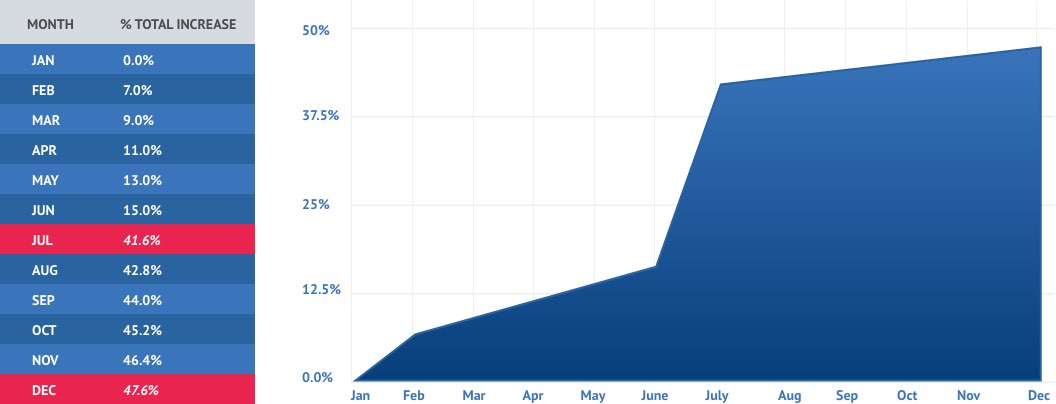

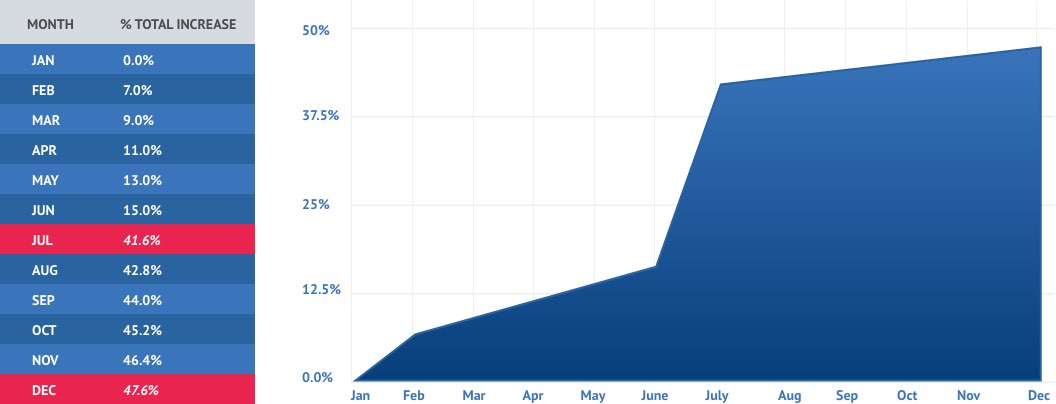

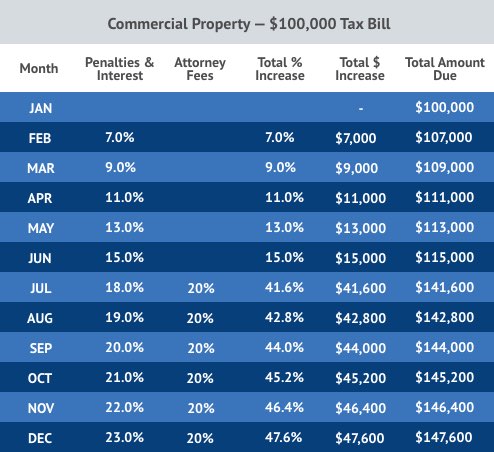

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Texas Income Tax Calculator Smartasset

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Texas Sales Tax Small Business Guide Truic

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Tax Rates Richardson Economic Development Partnership

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Taxes Celina Tx Life Connected

Texas Sales Tax Guide And Calculator 2022 Taxjar

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Texas Sales Tax Guide For Businesses

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Sales Tax On Computer Software And Services In Texas Ahuja Clark Pllc

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

/cloudfront-us-east-1.images.arcpublishing.com/dmn/GLBMMJHOFZED7FWOZG5BWEWOBY.jpg)

With Record Home Prices Dallas Fort Worth Property Owners Can Count On A Bigger Tax Bite